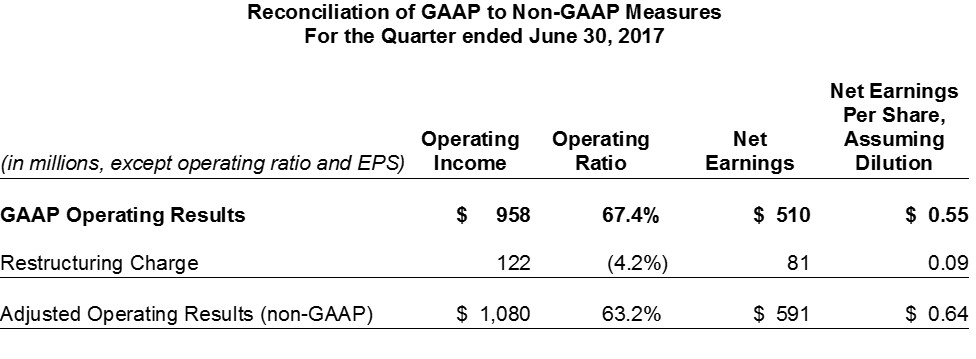

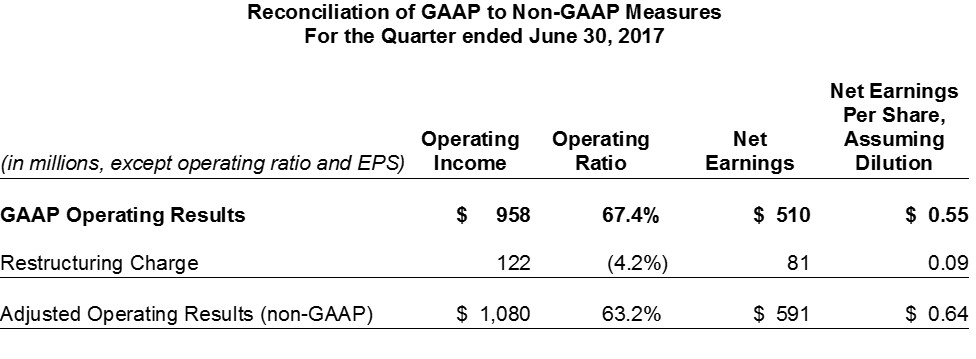

JACKSONVILLE, Fla. – July 18, 2017 – CSX Corporation (Nasdaq: CSX) today announced second quarter 2017 net earnings of $510 million, or $0.55 per share, up from $445 million, or $0.47 per share, in the same period of last year. Excluding a $122 million restructuring charge in this year’s second quarter results, adjusted earnings per share was $0.64 as shown in the table below.

“We are implementing Precision Scheduled Railroading on an expedited timetable, converting switching operations, balancing the network, streamlining resources and getting more out of our assets,” said E. Hunter Harrison, president and chief executive officer. “Although there still remains a lot to be done, we are confident that these initiatives will drive improved customer service, greater resource efficiency and superior shareholder value.”

Revenue for the second quarter increased 8 percent when compared to the previous year, with growth across nearly all markets. This growth was primarily driven by coal-related gains, strength in core pricing and volume across the other markets, and increased fuel recovery.

In the second quarter, CSX delivered improved asset utilization, cost control and fuel optimization. These operational improvements, coupled with the benefits from the management restructuring that was completed early in the second quarter, drove $90 million in efficiency gains. These gains more than offset the cost of inflation in the quarter.

CSX is intensely focused on implementing Precision Scheduled Railroading throughout the system. The company is on track to achieve record efficiency gains and a step-function improvement in its key financial measures for the year given continued economic growth and stable coal markets.

Adjusting for restructuring charges, CSX continues to expect to drive a full-year operating ratio in the mid-60s, earnings per share growth of around 25 percent off the 2016 reported base of $1.81, and free cash flow before dividends of around $1.5 billion (please see the company’s non-GAAP statements below).

As a result, the Board authorized an additional $500 million for the current share repurchase program, which now totals $1.5 billion. As part of this program, nearly $500 million of company shares were repurchased in the second quarter. At the same time, the company is currently evaluating its cash deployment strategy with respect to capital structure and shareholder distributions, and is committed to an investment grade rating.

CSX executives will conduct a quarterly earnings conference call with the investment community on July 19, 2017, at 8:30 a.m. Eastern time. Investors, media and the public may listen to the conference call by dialing 1-888-EARN-CSX (888-327-6279) and asking for the CSX earnings call. Callers outside the U.S., dial 1-773-756-0199. Participants should dial in 10 minutes prior to the call. In conjunction with the call, a live webcast will be accessible and presentation materials will be posted on the company's website at http://investors.csx.com. Following the earnings call, an internet replay of the presentation will be archived on the company website.

This earnings announcement, as well as additional detailed financial information, is contained in the CSX Quarterly Financial Report available through the company’s website at http://investors.csx.com and on Form 8-K with the Securities and Exchange Commission.

About CSX and its Disclosures

CSX, based in Jacksonville, Florida, is a premier transportation company. It provides rail, intermodal and rail-to-truck transload services and solutions to customers across a broad array of markets, including energy, industrial, construction, agricultural, and consumer products. For over 190 years, CSX has played a critical role in the nation's economic expansion and industrial development. Its network connects every major metropolitan area in the eastern United States, where nearly two-thirds of the nation's population resides. It also links more than 240 short-line railroads and more than 70 ocean, river and lake ports with major population centers and farming towns alike.

This announcement, as well as additional financial information, is available on the company's website at http://investors.csx.com. CSX also uses social media channels to communicate information about the company. Although social media channels are not intended to be the primary method of disclosure for material information, it is possible that certain information CSX posts on social media could be deemed to be material. Therefore, we encourage investors, the media, and others interested in the company to review the information we post on Twitter (http://twitter.com/CSX) and on Slideshare (http://www.slideshare.net/HowTomorrowMoves). The social media channels used by CSX may be updated from time to time.

More information about CSX Corporation and its subsidiaries is available at www.csx.com and on Facebook (http://www.facebook.com/OfficialCSX).

Non-GAAP Measures Disclosure

CSX reports its financial results in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). CSX also uses certain non-GAAP measures that fall within the meaning of Securities and Exchange Commission Regulation G and Regulation S-K Item 10(e), which may provide users of the financial information with additional meaningful comparison to prior reported results. Non-GAAP measures do not have standardized definitions and are not defined by U.S. GAAP. Therefore, CSX’s non-GAAP measures are unlikely to be comparable to similar measures presented by other companies. The presentation of these non-GAAP measures should not be considered in isolation from, as a substitute for, or as superior to the financial information presented in accordance with GAAP. Reconciliations of non-GAAP measures to corresponding GAAP measures are above.

Forward-looking Statements

This information and other statements by the company may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act with respect to, among other items: projections and estimates of earnings, revenues, margins, volumes, rates, cost-savings, expenses, taxes, liquidity, capital expenditures, dividends, share repurchases or other financial items, statements of management's plans, strategies and objectives for future operations, and management's expectations as to future performance and operations and the time by which objectives will be achieved, statements concerning proposed new services, and statements regarding future economic, industry or market conditions or performance. Forward-looking statements are typically identified by words or phrases such as “will,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate,” “preliminary” and similar expressions. Forward-looking statements speak only as of the date they are made, and the company undertakes no obligation to update or revise any forward-looking statement. If the company updates any forward-looking statement, no inference should be drawn that the company will make additional updates with respect to that statement or any other forward-looking statements.

Forward-looking statements are subject to a number of risks and uncertainties, and actual performance or results could differ materially from that anticipated by any forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by any forward- looking statements include, among others; (i) the company's success in implementing its financial and operational initiatives; (ii) changes in domestic or international economic, political or business conditions, including those affecting the transportation industry (such as the impact of industry competition, conditions, performance and consolidation); (iii) legislative or regulatory changes; (iv) the inherent business risks associated with safety and security; (v) the outcome of claims and litigation involving or affecting the company; (vi) natural events such as severe weather conditions or pandemic health crises; and (vii) the inherent uncertainty associated with projecting economic and business conditions.

Other important assumptions and factors that could cause actual results to differ materially from those in the forward-looking statements are specified in the company's SEC reports, accessible on the SEC's website at www.sec.gov and the company's website at www.csx.com.

Contacts:

David Baggs, Investor Relations

904-359-4812

Rob Doolittle, Corporate Communications

202-626-4939